past due excise tax ma

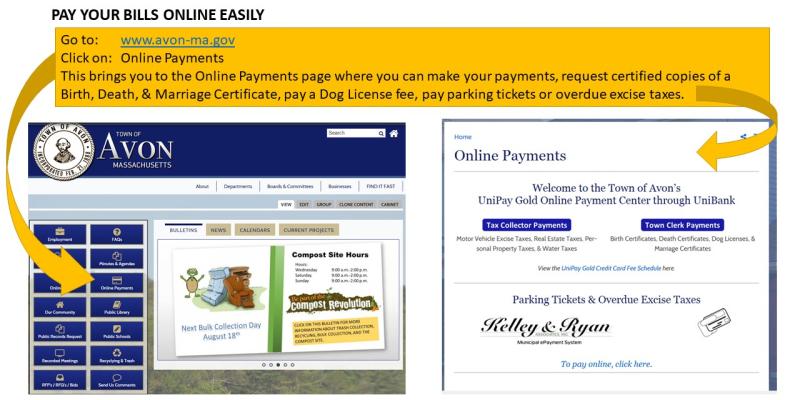

You may also pay your excise bills excise demand bills and real estate tax bills. If the bill goes unpaid interest accrues at 12 per annum.

Excise Tax In Mass 2019 Pp2 2015 S550 Mustang Forum Gt Ecoboost Gt350 Gt500 Bullitt Mach 1 Mustang6g Com

Drivers License Number Do not enter vehicle plate numbers.

. Certain drivers license vehicle registration and title transactions suspension payments and learners permit testing. First installment is due on or before April 19 2022. Bills that are more than 45 days past.

Road Closure Information for. The excise rate as set by statute is 25 per thousand dollars of valuation. Learn if your corporation has nexus in.

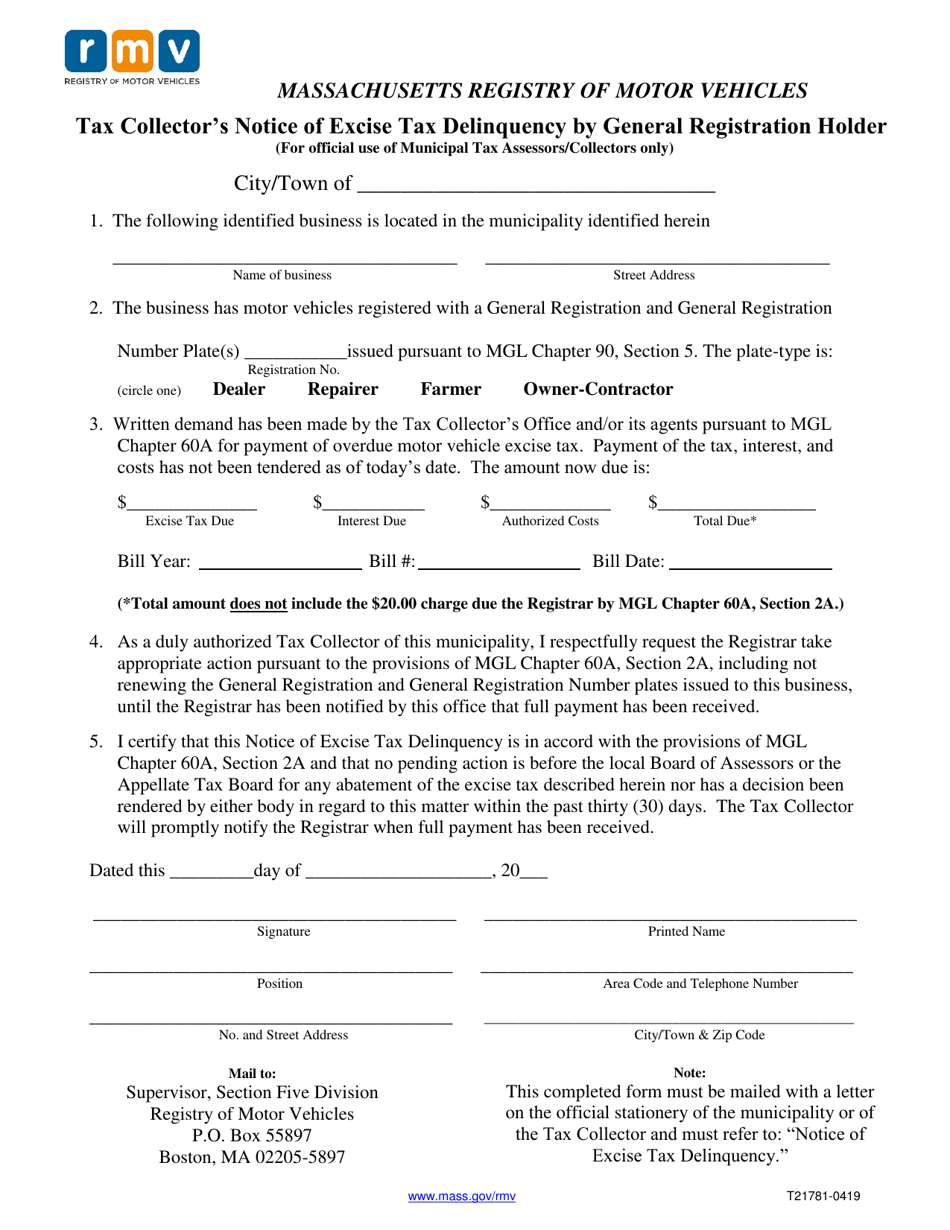

YEARS IN BUSINESS 781 477-4272. Excise tax bills are prepared by the Registry of. For payment of past.

Second installment is due on or before June 15 2022. Need to pay a past due excise. THIS FEE IS NON-REFUNDABLE.

Jones Associates 98 Cottage Street P O Box 808 Easthampton MA. Travelodge Hotel - London Central Waterloo. Massachusetts imposes a corporate excise tax on certain businesses.

Motor Vehicle Excise bills that have been issued a warrant or have been flagged at the Registry of Motor vehicles MUST be paid to. The tax is due on the 15th day of the third for S corporations or fourth. Nonpayment of a bill triggers a demand bill to be produced and a.

How often do you pay excise tax in MA. Excise tax bills are due annually for every vehicle owned and registered in Massachusetts. Motor Vehicle Excise Tax bills are due in 30 days.

We strongly encourage you to pay your Excise tax bills online or by dropping the check and bill in the outside dropbox on the circle driveway at. Pay Past Due Excise Tax Bills. If you dont make your payment within 30 days of the date the City issued the excise.

Gardner MA 01440 Phone. How do I pay my excise tax in Randolph MA. Not just mailed postmarked on or before the due date.

55 Main Road Colrain MA 01340. Generally all corporations operating in Massachusetts both foreign and domestic need to pay corporate excise tax. To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287.

Payment of the motor vehicle excise is due 30 days from the date the excise bill is issued not mailed. Tax And Utility Bills. 98 Cottage Street Easthampton MA 01027 413-527-2388 413-529-0924 Fax.

Real Estate Auction July 15 2015. Find your bill using your license number and date of birth. The Texas excise tax on cigarettes is 141 per 20 cigarettes higher then 52 of the other 50 states.

Corporate excise can apply to both domestic and foreign corporations. For excise tax bills that have gone to Warrant you will need to contact and pay to our Deputy Tax Collector. WE DO NOT ACCEPT.

Get a copy of your tax. A motor vehicle excise is due 30 days from the day its issued. Please note all online payments will have a 45 processing fee added to your total due.

Third installment is due on or before September 15 2022. Motor Vehicle Excise FAQs. Online Bill Pay for Real Estate Personal Property Excise Utility.

Online Payment Search Form. Excise tax payments are due 30 days from the original date of the bill after which a demand bill will be sent out with interest and penalty. Learners permit tests for Class D or M offered 900 am - 400 pm.

If you are unable to find your bill try searching by bill type. Motor vehicle excise tax bills are due and payable within thirty days from the date of issue. The tax collector must have received the payment.

957 likes 6 talking about this 17078 were here. Pay your taxes through our Online Payment Gateway.

Form T21781 Download Printable Pdf Or Fill Online Tax Collector S Notice Of Excise Tax Delinquency By General Registration Holder For Official Use Of Municipal Tax Assessors Collectors Only Massachusetts Templateroller

Hingham Excise Tax Fill Online Printable Fillable Blank Pdffiller

Marijuana Excise Tax By States Download Table

Edelstein Company Llp Tax Alert Massachusetts Enacts Elective Pass Through Entity Excise

Excise Tax What It Is How It S Calculated

Baker Wants To Hike Excise Tax To Fight Climate Change Others Say It Should Help Housing Crisis Wbur News

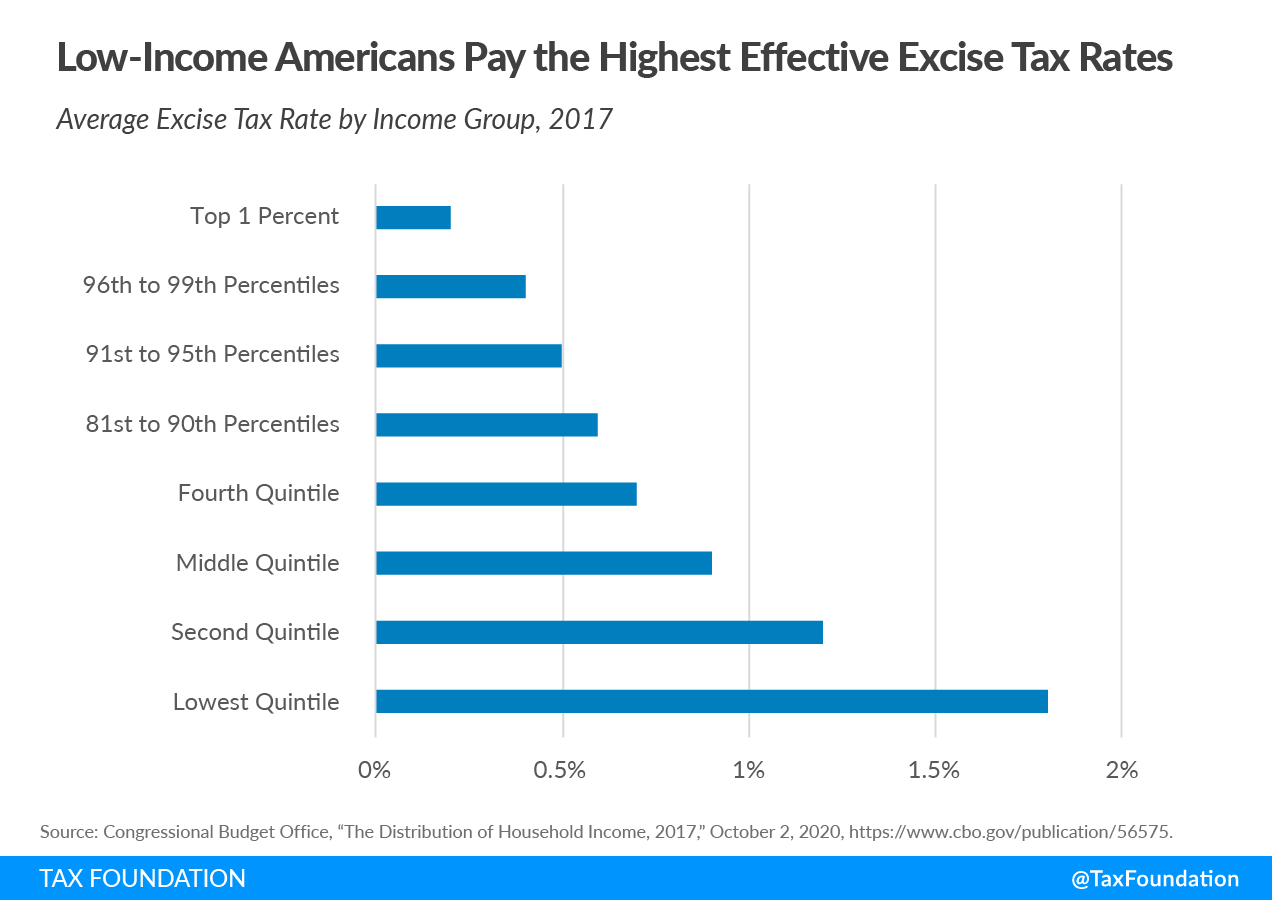

Excise Taxes Excise Tax Trends Tax Foundation

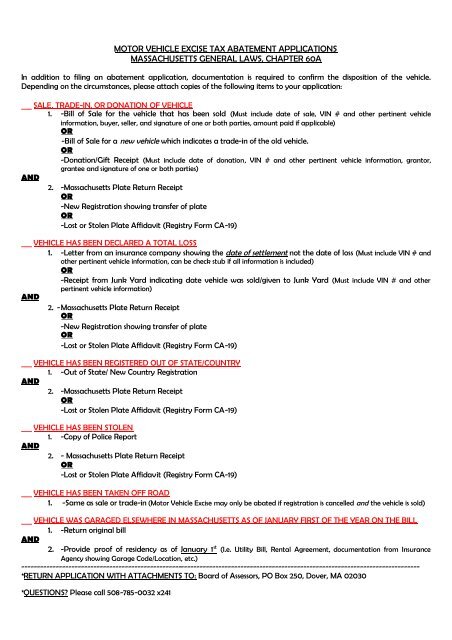

Motor Vehicle Excise Tax Abatement Applications Massachusetts

Corporate And Other Business Excise Description

Motor Vehicle Excise Tax Plainville Ma

Look Up Pay Bills Town Of Arlington

Chicopee Residents See Late Fees After Allegedly Not Receiving Excise Tax Bills

Did You Know Motor Vehicle Excise Tax

Massachusetts Enacts Pass Through Entity Excise Tax For 2021 Calendar Year Marcum Llp Accountants And Advisors